Starting a Business: A Cautionary Tale

Starting a business can be both an exciting and nerve-racking time in the life of the prospective owner. Prospective business owners often begin with a grand idea on which to build a successful company, but do not know what steps to take to form the underlying business entity. Further, once the business entity is formed, owners are regularly left adrift to comply with the legal requirements which periodically arise. Additionally, there are multiple companies who attempt to prey on new business owner’s insecurities and unsureties when it comes to these legal requirements. Stuart & Clover, PLLC seeks to remedy these issues for both new and existing businesses through our Annual Business Package.

When forming a new business, it is imperative to have a solid legal foundation. Like any worthwhile endeavor, proper structure and planning at the outset often leads to security later on. The first step is determining what type of business entity best suits your needs. In Oklahoma the four main types of business include: Corporations, Limited Liability Companies, Partnerships, and Charitable/Non-Profit Entities. Each of these types has different benefits and drawbacks depending on the individual needs for your prospective business. For instance, a Limited Liability Company enjoys certain beneficial tax treatment, limitations on liability of its members (owners), and relative ease of use. However, Limited Liability Companies are not applicable to every business and thus an individualized assessment is necessary.

After a business entity has been structured and approved by the Secretary of State, IRS, and other governmental agencies, there are certain periodic requirements a business must follow in order to remain a legally recognized entity. This can include yearly shareholder meetings, annual filing fees, and periodic board approval of company actions. Requirements such as these can often bog down and intimidate a business owner. More often than not, these continuing necessities fall through the cracks and are forgotten. When periodic requirements are left by the wayside, it opens up the business owner to possible fines, personal liability for actions of the company, and/or complete loss of legally recognized business status. It is therefore crucial the periodic requirements be continually complied with.

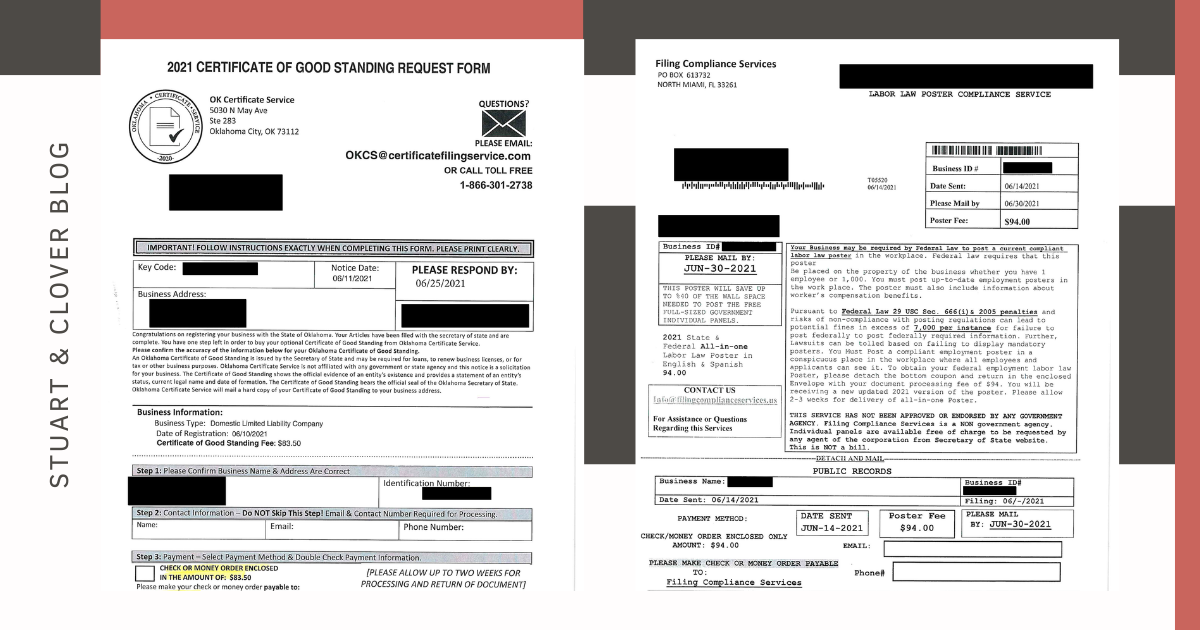

Knowing that business owners are often without full knowledge of what is legally required, certain companies will target newly formed businesses in an attempt to obtain payment for certain services. These companies will offer to provide certificates of good standing, posters describing labor and employment laws, or certificates showing Employment Identification Numbers. While it is true that some of these services are necessary for some businesses, it is heavily dependent on the circumstances of each individual business. Further, these companies charge exorbitant fees, fully hoping the business owner is unaware of the reasonable cost associated with these items. We have included some examples of these companies’ mailings below. Click here or the image below to download.

Business owners often contact our firm to fix their faulty business entity structures, correct oversites with periodic requirements, and verify whether certain steps are necessary for their individual business. Seeing the need in our community, Stuart & Clover, PLLC has established an Annual Business Package. For $250.00 per year, Stuart & Clover, PLLC will act as the registered agent for the business, file the annual certificates required, and pay the annual renewal fee. Enrolling in the Annual Business Package will allow you to focus on what you specialize in: your business. Rest assured knowing that the legal requirements will be taken care of and will not slip through the cracks.